who pays sales tax when selling a car privately in florida

According to the Florida Department of Highway Safety its best to complete the transaction at the tax. All of the conditions that apply when buying a vehicle from an individual in a private sale also apply when buying inheriting or being gifted a vehicle from a family member.

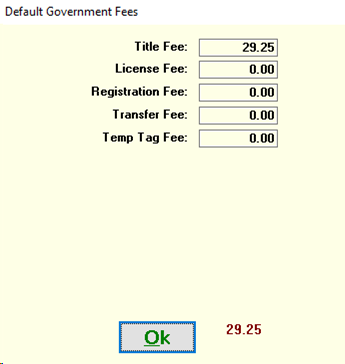

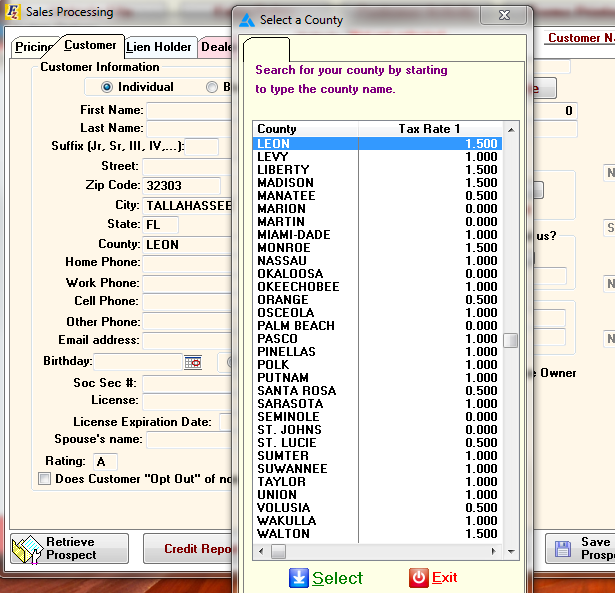

Frazer Software For The Used Car Dealer State Specific Information Florida

However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in.

. Personal vehicle sales in New Jersey are not subject to the states 6625 percent sales tax if the seller does not hold a. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle.

Answer 1 of 9. Or private tag agency. Sales to someone from a state with sales tax less than Florida.

But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car. Check that the VIN appears the same on the title certificate as it does on the vehicle. You will pay less sales tax when you trade in.

No discretionary sales surtax is due. You pay 1680 in state sales tax 6 of 28000. The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel Form HSMV 82050 can be downloaded and printed.

Sale of 20000 motor vehicle to a. Florida collects a 6 state sales tax rate on the purchase of all vehicles. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

That depends on the sate and the laws regarding sales tax. To sell the motor vehicle the lien first has to be satisfied. Remember the sales price does not include sales tax or tag and title fees.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. Who pays sales tax when selling a car privately in NJ. It will need to.

This is generally referred to as curbstoning. Do I have to pay sales tax when I transfer my car title if the car was given to me. Florida law prohibits the parking of any vehicle on public right of ways or on private property for the purpose of sale without the permission of the property owner.

Collect the buyers home state rate up to Florida. Motor vehicles is 7. Expect to pay these fees to a.

For example if you decide to sell privately. Its illegal in Florida to sell a vehicle privately with an existing lien. Additionally Florida law presumes any person firm.

Floridas general state sales tax rate is 6 with the following exceptions. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in. Fully executed Form DR-123 must be signed at time of sale.

Florida Vehicle Sales Tax Fees Calculator

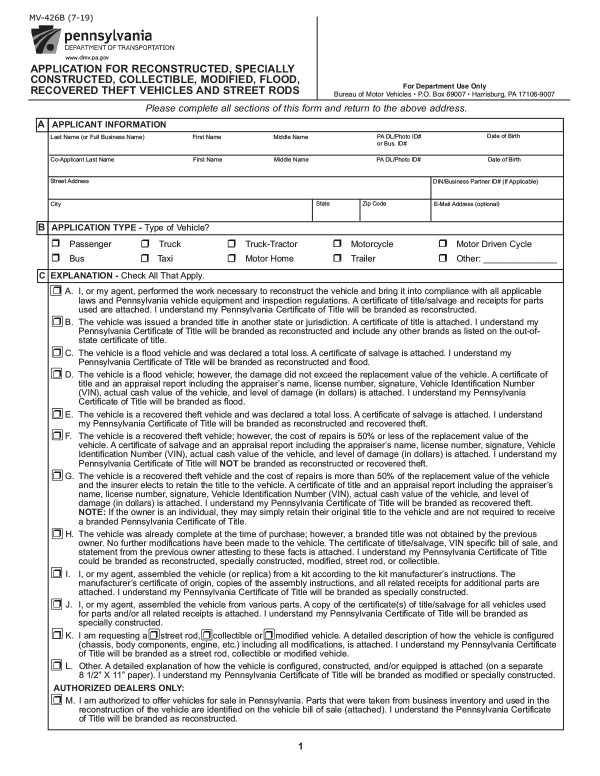

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

.png)

How To Calculate Florida Sales Tax On A Car Squeeze

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Frazer Software For The Used Car Dealer State Specific Information Florida

Car Tax By State Usa Manual Car Sales Tax Calculator

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Understanding California S Sales Tax

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

Selling A Car In Florida A Former Dealers Advice

How To Protect Yourself From Liability When Selling Your Used Car

Motor Vehicles And Vessels Alachua County Tax Collector

Selling A Car In Florida A Former Dealers Advice

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Free Florida Vehicle Boat Bill Of Sale Form Hsmv 82050 Pdf Eforms